梅赛德斯-奔驰的阿拉巴马州比布县电池厂正在组装锂离子电池,以供其附近的塔斯卡卢萨整车装配厂使用。在拍摄这张照片三年后的今天,电池产能扩张依然是业界关注的焦点,北美汽车制造商和全球最大的电池制造商仍在竭力扩张其超级工厂的电池产能。(梅赛德斯-奔驰)

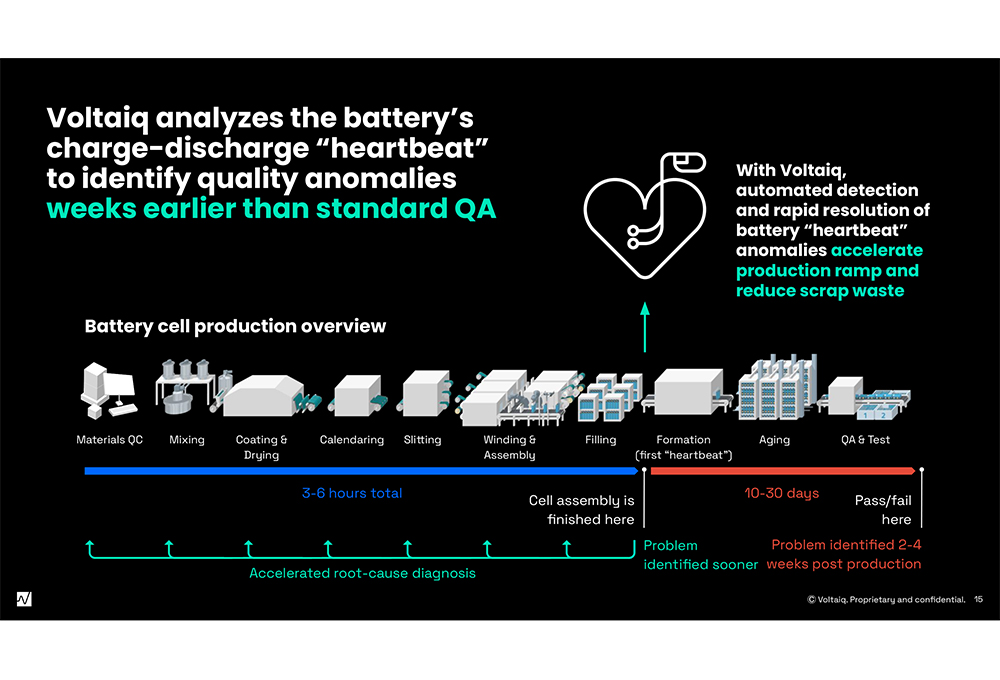

梅赛德斯-奔驰的阿拉巴马州比布县电池厂正在组装锂离子电池,以供其附近的塔斯卡卢萨整车装配厂使用。在拍摄这张照片三年后的今天,电池产能扩张依然是业界关注的焦点,北美汽车制造商和全球最大的电池制造商仍在竭力扩张其超级工厂的电池产能。(梅赛德斯-奔驰) Voltaiq的电池制造流程图显示,通过适当的数据收集和分析,可以更早地发现和解决某些问题。(Voltaiq)

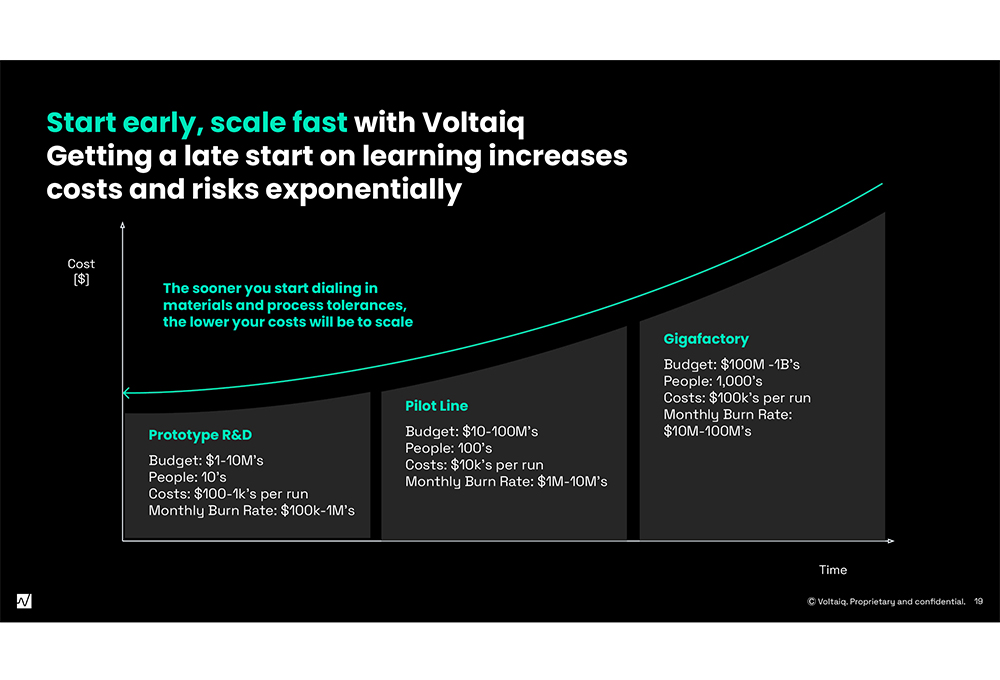

Voltaiq的电池制造流程图显示,通过适当的数据收集和分析,可以更早地发现和解决某些问题。(Voltaiq) Voltaiq的高管表示,及早发现电池制造问题的成本要低得多。(Voltaiq)

Voltaiq的高管表示,及早发现电池制造问题的成本要低得多。(Voltaiq)

Voltaiq首席执行官表示,北美OEM和电池制造商的学习和技术迭代速度远不及中国同行。

电池分析公司Voltaiq首席执行官Tal Sholklapper在底特律举行的一次媒体吹风会上警告称,北美汽车制造商和电动汽车电池公司必须在五年内赶超中国同行的电池技术和制造水平,否则在可预见的未来,他们可能不得不从中国进口电池。

Sholklapper指出,“中美电池产业竞争已进入最终阶段。如果北美电池、电动车以及相关应用行业想要赢得竞争,就必须改变现有的运作方式。”

他指出,这意味着:

-

电池制造商必须专注于提高电池生产质量、积极引进外部专家(如数据分析专家)、加快学习和技术迭代速度,并尽快实现规模化生产。虽然这些要求看似理所当然,但许多电池制造商并未做到。他们往往不了解工厂出品的电池质量,直到车辆上路后才发现问题,这导致了多起代价高昂的产品召回事件和安全事故。

-

Sholklapper指出,OEM必须承认自己制造电池存在问题,而且也不能简单地让电气工程师负责电池制造。Sholklapper常把电池比作“会呼吸的生命体,因为电池在充放电过程中会发生膨胀和收缩。”

Voltaiq提倡在电池制造过程中持续监控数据,以便及时发现并解决问题,从而避免延误或经济损失。Sholklapper指出,目前一些电池工厂仍然在每个制造环节使用U盘采集数据,然后再进行集中分析。这种数据采集方式并不实时,Voltaiq的部分业务就是帮助客户采集实时数据。

Voltaiq首席技术官Eli Leland指出,OEM在扩大超级工厂的电池产能时面临的一大问题在于使用了错误的专家。Leland指出,“特斯拉会请底特律动力总成工程师来设计电池包吗?显然不会。”他强调,电池在本质上是电化学设备,其化学特性才是最难掌握的。

在此次媒体吹风会上,Voltaiq还宣布与加拿大电池材料和测试公司Novonix建立合作伙伴关系。根据合作协议,Voltaiq将为Novonix提供数据分析和电池正负极材料业务支持,以助力其实现产品商业化。此外,两家公司将共同为使用Novonix超高精度库仑计设备(用于测试锂离子电池性能的设备)和研发服务的客户提供技术支持。

Novonix总裁Lori McLeod表示,公司已经认识到外部专家的重要性。她指出,“大约一年半之前,我们曾投入大量资金,尝试自主开发软件。但在一年半后,我们不得不扪心自问:仅靠自己,行得通吗?”

Voltaiq CEO says OEMs and battery makers just aren't learning and iterating as fast as China's industry has.

North American automakers and EV battery firms have five years to erase China’s dominance in technology and manufacturing or they may face the reality of buying batteries from China for the foreseeable future. That was the message from battery-analysis company Voltaiq CEO Tal Sholklapper at a media briefing in Detroit.

“We’re in the final innings now,” Sholklapper said. “If the industry around batteries and electric vehicles and all the follow-on applications wants to make it, we're going to have to change the way we play.”

That means, he said:

- Battery manufacturers need to narrow their focus on making high-quality cells, bringing in outside experts on things like analytics. They must learn and iterate faster and get to scale as fast as possible. This might seem intuitive, but many of the expensive recalls and dangers in the industry have been the result of not knowing enough about the quality of a factory’s output until the batteries are already in a vehicle on the road.

- OEMs, Sholklapper said, must admit that making batteries in-house is problematic, and that electrical engineers can’t just switch to making batteries. Sholklapper often refers to batteries as living, breathing beings, since they expand and contract under charge and draw conditions.

Voltaiq advocates constantly monitoring data during the manufacturing process so problems can be addressed quickly before they result in delays or monetary losses. Sholklapper said that some of today’s battery factories even gather data by plugging thumb drives into machines at each step in manufacturing before collecting it in one place for analysis. Part of Voltaiq’s work is helping clients gather that data in real-time.

Eli Leland, Voltaiq’s CTO, said part of the problem OEMs have trying to scale directly to batteries in huge gigafactories is having the wrong experts on hand. “Did Tesla hire a bunch of powertrain engineers from Detroit to come and design their battery packs? We know the answer, right?” He underscored that batteries are electrochemical in nature, and it’s the chemistry part that is most difficult to master.

And unlike the consumer electronics industry, which was able to perfect batteries in low volume, high value products before scaling, those products are rare in the automotive world, Leland said, pointing to examples like the Mercedes G-class EV.

Sholklapper also underscored the importance of OEMs and battery companies taking a collaborative approach to development. “You need to focus on your core strength. And whether it's the vehicle integration, whether it's making cells… One thing that you need to do to be successful is focus on that and then bring in best-in-class providers to help you with the rest.” He also said that as long as China’s subsidized industry can produce batteries for around $50 per kilowatt-hour, it would keep pressure on North American industry.

The briefing also served as an introduction to Voltaiq’s new partnership with Novonix, a Canadian battery materials and testing company. The agreement calls for Voltaiq to handle Novonix’s analytics and support the company’s anode and cathode materials business as it nears product commercialization. Together, the companies will support customers of Novonix’s ultra-high precision coulometry equipment (that tests lithium-ion battery performance) and R&D services.

Lori Mcleod, president of Novonix, said the company had experience in learning the value of outside experts. “About a year and a half ago, we went down this path of trying to do our own thing. We're going to become software makers,” she said. “And after a year and a half of investment, it was hard to ask ourselves the question, should we be doing this anymore?”

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分