NHTSA并未发现特斯拉Model S前悬挂存在设计缺陷的证据。

NHTSA并未发现特斯拉Model S前悬挂存在设计缺陷的证据。

今年晚春时分,一阵骚动在特斯拉汽车公司(Tesla Motors)与一名因勇敢批判特斯拉汽车而闻名的记者之间迅速蔓延,又迅速平息,但这使得人们开始关注汽车制造中的一些额外费用,而这一直是一些科技公司在进军汽车行业时并未意识到的。

据了解,每日看板(Daily Kanban)记者Ed Niedermeyer 透露,虽然并无书面规定,但特斯拉汽车在为客户进行某些标准保修范围之外的修理时,通常会要求客户先签订全面保密协议(NDA),而这可以被解读为特斯拉在试图掩盖某些车辆设计中的潜在问题,以回避美国高速公路交通安全局(NHTSA)日益严苛的审查。

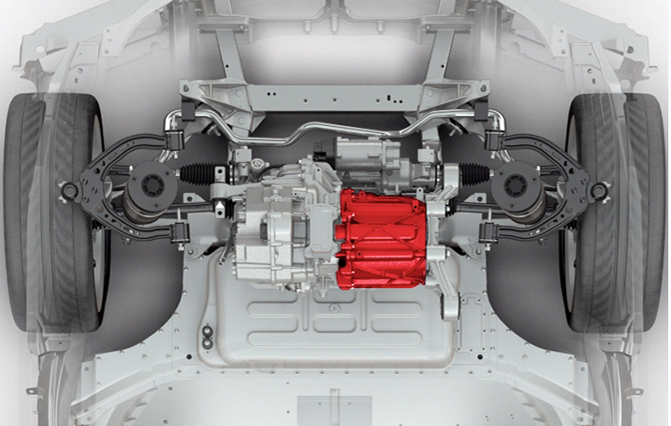

NHTSA迅速召集了一场针对特斯拉的调查,速度之快令人吃惊,但结果并无证据显示特斯拉Model S的前悬挂存在任何具有普遍性的,或根本性的设计问题。不过,本次调查却揭露了一个令人不安的现实,那就是特斯拉在大规模市场中开发与销售汽车的方式。

之前,特斯拉CEO Elon Musk对批判者的首次回应,已经成为一场特斯拉与痛斥特斯拉的媒体之间的标志性论战。Musk指控Niedermeyer与华尔街的“做空者”同流合污,但他本人白手起家,财富迅速增长的现实却让这一指控显得站不住脚。在这一点上,成熟的汽车公司绝对可以做的更好,他们最起码知道一家公司的CEO绝不该像个NBA怨妇或过气明星一样卷入Twitter的世界。

不过,在我看来,Musk有关“做空者”的指控反而透露了他本人的真实想法。作为特斯拉的CEO,Musk最关心的是针对故障悬架的报道可能会导致公司股价下跌,而并不是Model S的悬挂系统到底有没有设计问题(或者说制造问题),他也并不关心特斯拉要求客户签署有关潜在安全问题的保密协议是否符合监管机构对汽车公司的要求(当然,特斯拉还是修改了保密协议的措辞)。

Musk似乎极为担心负面新闻可能会给公司财务状况带来影响。不过,除了柴油发动机排放门这样的丑闻之外,通常这样的问题还不至于让老牌的跨国汽车公司及其背后生产研发帝国的高管忧虑到睡不着觉。

在爆出故障悬挂问题的几周前,特斯拉又开始了新一轮的股票出售,以补充公司的现金储备,但规模仅为15亿美元。这里要说明一个背景,在特斯拉公司出售股票的前一天,有报道称通用汽车(General Motors)将拿出大约1亿美元,补偿购买燃料经济性数据不符的雪佛兰(Chevrolet)、CMC和别克(Buick)全尺寸跨界车的车主。实际上,通用汽车已经支付了这1亿美元,只是一些文件未能及时更新。

特斯拉有能力应对这样的问题吗?

汽车是世界上最复杂的消费产品之一,而汽车的开发、设计及把关绝对是一项非常花钱的工作,这点大家肯定都明白。在我看来,特斯拉最近深入汽车行业与消费者之间“虫洞”的探险简直称得上一记响亮的耳光,提醒了大家为何像苹果(Apple)与谷歌等富可敌国的科技公司也不可能独自承担整车开发与制造的工作。

“汽车可不是手机”,这是汽车公司的工程师和高管在向消费者与监管机构解释消费电子产品与汽车的区别时,经常挂在嘴边的一句话。一些“搅局者”其实很明白这个道理,因此他们寻求的是如何以一种最有利的方式参与汽车研发,但绝不会直接去开发制造汽车。

而Musk等其他人却选择了一条不同的路。不过汽车的研发费用如此之高,恐怕是这些亿万富翁之前没有想到的。

作者:Bill Visnic

来源:SAE《汽车工程》杂志

翻译:SAE中国办公室

A late-spring brouhaha that developed between Tesla Motors and an intrepid reporter known for skeptical Tesla coverage blew over fairly quickly—but not before highlighting some unaccounted costs of car-making that the tech world tends to gloss over on the path to auto-industry disruption.

In uncovering Tesla’s largely undocumented practice of expecting customers to sign comprehensive non-disclosure agreements (NDAs) before the company would make certain repairs outside the standard warranty coverage, The Daily Kanban’s Ed Niedermeyer shed light on what could have been interpreted as Tesla’s attempt to shield potentially faulty engineering from the increasingly scrutinous watch of theNational Highway Traffic Safety Administration.

A NHTSA investigation—convened surprisingly quickly, I’ll say—found no evidence of widespread or intrinsic design problems with the Tesla Model S front suspension. But the evolving situation exposed uncomfortable realities behind Tesla’s approach to developing and selling vehicles in the mass market.

There was a thin-skinned social-media tongue lashing that’s become a hallmark of Tesla CEO Elon Musk’s first response to detractors. His dislocation from non-billionaire reality will never be more hilariously evident than is his accusation that Niedermeyer was in cahoots with Wall Street short-sellers. Mature car companies know better, even before any debate about whether a CEO should be engaging the world on Twitter as if they’re NBA wives or desperate celebrities.

More telling to me about the short-selling angle, though, was what it suggested about Musk’s overriding state of mind. To Tesla’s CEO, the effect of the faulty-suspension story on the company’s stock price appeared to be the underlying concern, not whether the Model S suspension design (or, more likely, manufacturing execution) was faulty. Or whether Tesla’s NDA practices were not in alignment with regulators’ expectations of how a car company should relate with its customers when it comes to matters of potential safety. (Tesla did, as a result, modify the language of its NDAs.)

Musk seems to be immensely concerned about how negative news might affect his company’s financial position. Such a worry, diesel-engine emissions cheating excepted, generally doesn’t cause lost sleep for multinational auto companies and their asset-backed manufacturing and development empires.

A few weeks prior to the break of the suspension story, Tesla initiated another stock sale—this one to the tune of about $1.5 billion—to bolster its cash reserves. The relative meagerness of that figure was placed in perspective a day before Tesla’s stock issue when it was reported General Motors was set to earmark an estimated $100 million merely to make good with consumers who’d purchased someChevrolet, GMC and Buick fullsize crossovers sold with mislabeled fuel-economy ratings. In effect, GM was paying out a tenth of a billion dollars because somebody neglected to update some files.

How many of those could a company like Tesla handle?

Developing and engineering—and then guaranteeing—the world’s most-complex consumer products is an immensely capital-intensive endeavor. That’s not news. But Tesla’s latest abbreviated adventure into the worm-hole connecting the industrial and consumer universes provided, in my view, one of the starkest reminders yet of why even fabulously rich tech companies such as Apple andGoogle are unlikely to ever undertake the development and manufacture of entire vehicles.

“Cell phones aren’t cars” is the adage auto-company engineers and executives often deploy to give perspective to the extra layers of consumer and regulatory liability that come with manufacturing vehicles, compared with consumer electronics. Some disruptors understand and are working on how to most profitably participate in automotive development—without taking over.

Others, like Musk, have ushered in wonderful slices of disruption. But taking over has costs even billionaires can’t comprehend.

Author: Bill Visnic

Source: SAE Automotive Engineering Magazine

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分

- 作者:Bill Visnic

- 行业:汽车

- 主题:车辆与性能